FIG Restaurant Captive’s Insurance Process

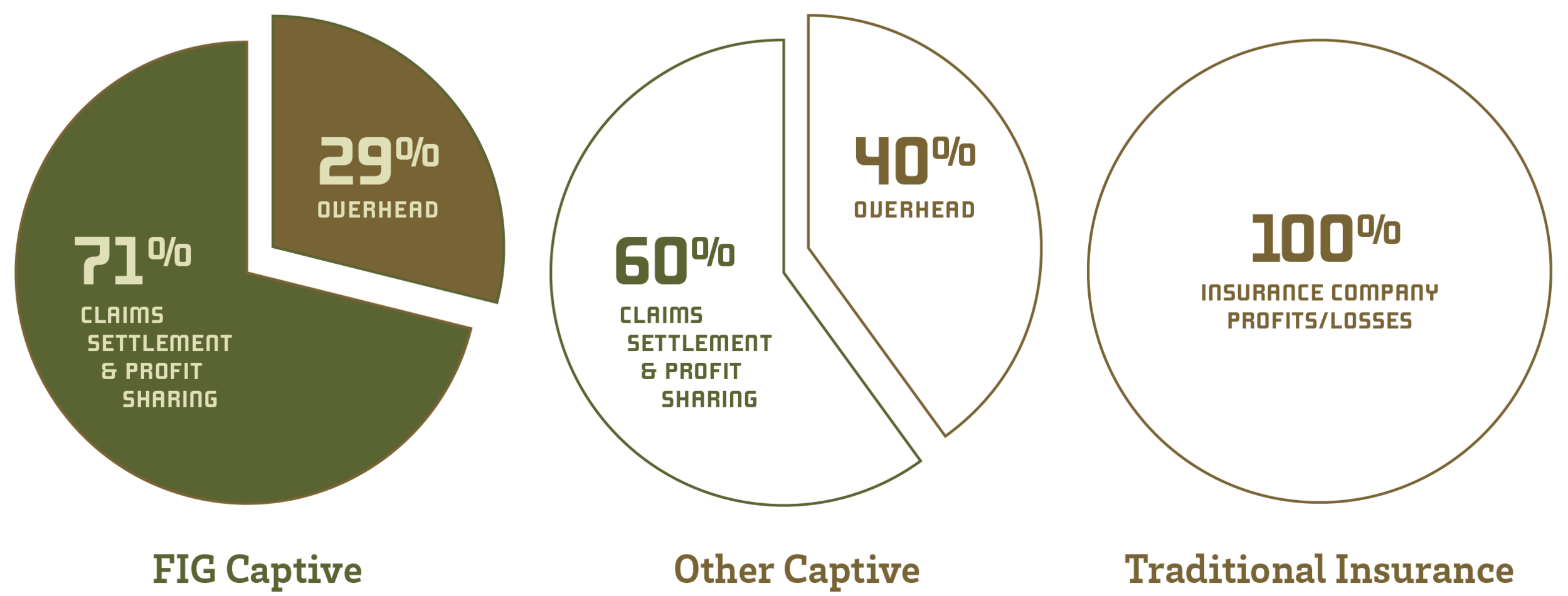

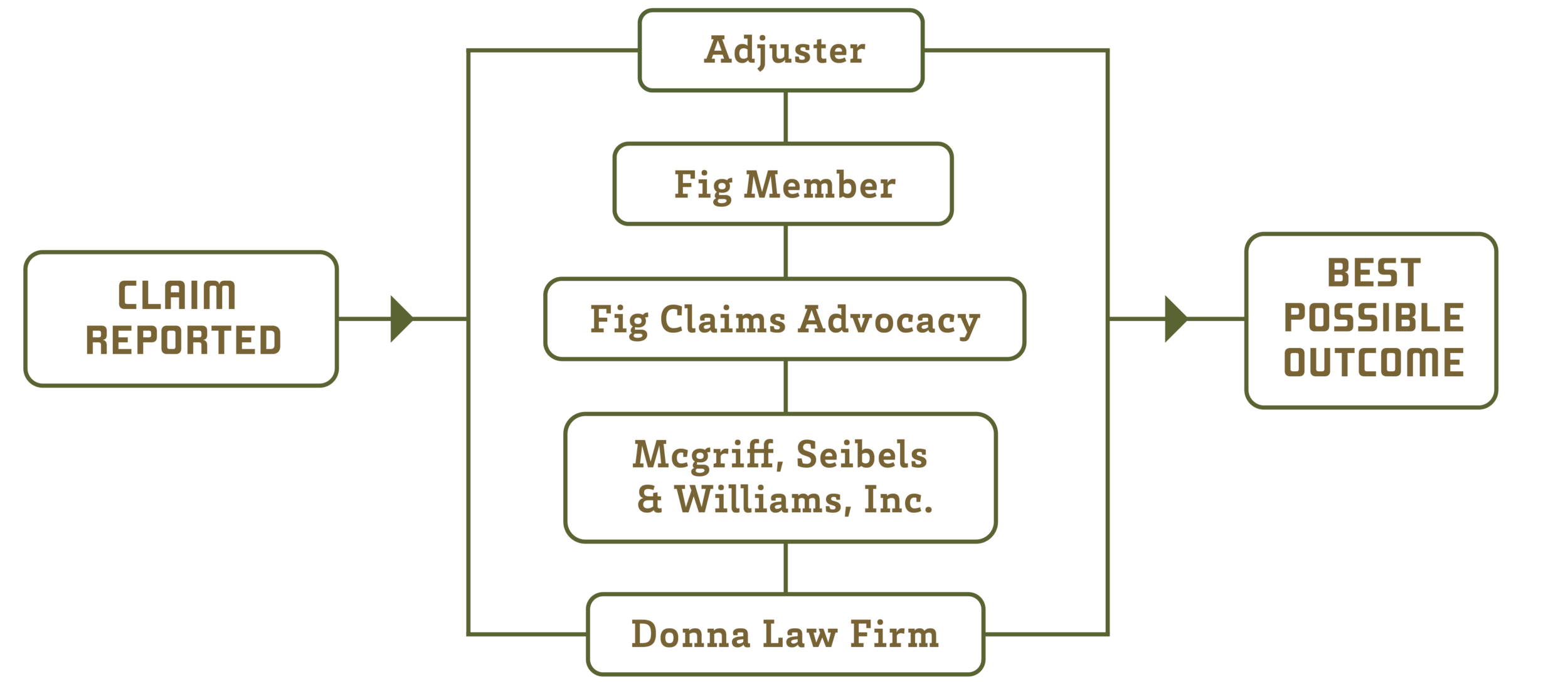

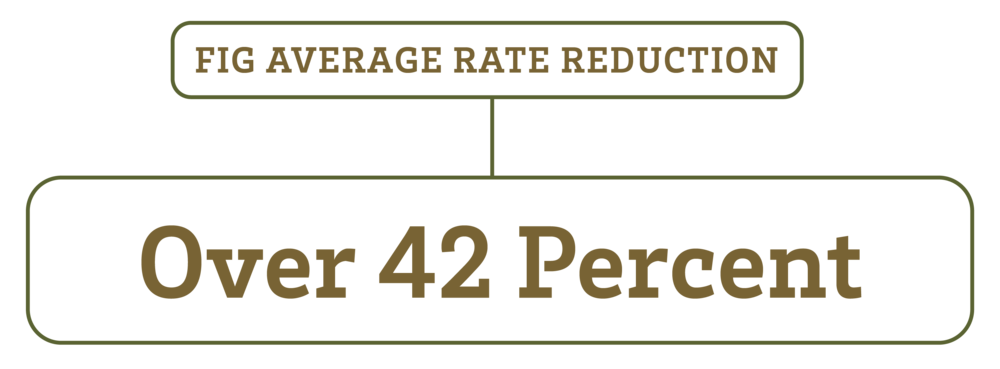

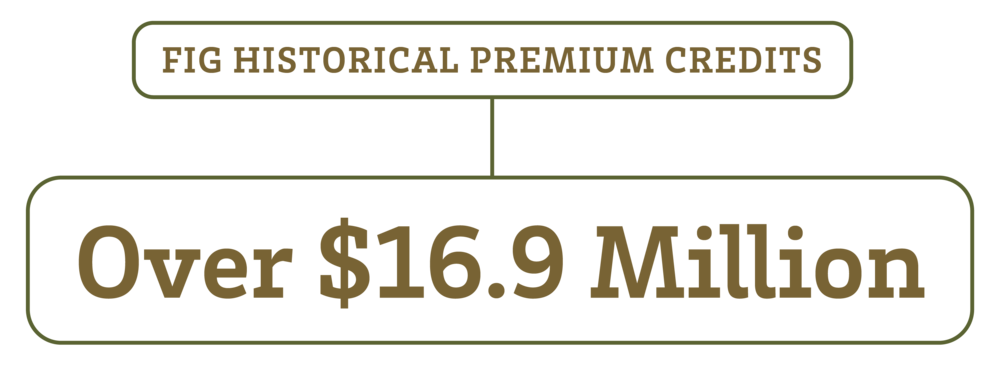

Our process is unique in that our captive is member-owned and specifically designed to benefit our clients bottom line. How does FIG accomplish this? We provide solutions for cost-efficient premium development, collaborative loss control and aggressive claims management.